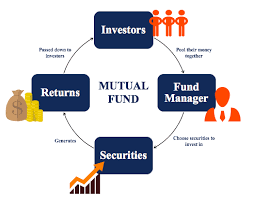

Mutual Funds offer a number of ways through which an investor can make investments in their funds. Investment in shares/equity of a company is process to be carried out with utmost care, after lot of analysis and researches. Around 5000 companies are listed in the Bombay Stock Exchange (BSE). The number of companies listed in National Stock Exchange (NSE) is around 2000. Mutual funds invest in equities, bonds and government securities. Compared to the number of companies listed in stock exchanges, the number of mutual fund schemes is less. However, you will be surprised to know that there are around 1100 MF schemes offered by different mutual funds are available for investment. Hence, investment in mutual funds too require proper due diligence before investment to ensure capital appreciation or income by way of dividend.

A. Channels available for Mutual Fund investment

The success of investment in mutual fund scheme too depends on the time spend in analyzing various schemes and understanding their investment patterns. In 2018, in order to enable investors to compare various similar schemes offered by different MF houses and to bring more transparency, SEBI brought in rationalization of schemes. Accordingly, fund houses are required to categorize their MF schemes under five broad categories. They are:

- Equity schemes

- Debt schemes

- Hybrid schemes ( a mix of equity and debt),

- Solution-oriented schemes ( For special purposes like education, retirement etc) and

- Other schemes (Index funds, Exchange-traded funds, Fund of Funds etc).

The first step involved in MF investment is making investment in the most appropriate MF scheme. Commonly available channels for investment are mentioned below:

a. MF Investment through Agent/ Distributor

Investment through an agent/ distributor is the best suited mode for first time investors. An experienced mutual fund distributor / agent can guide an investor in choosing the most appropriate MF scheme. An investor should ensure that the investment style and underlying risks are matching with his risk profile. This depends on various factors like present age of the investor, time horizon available for investment, the purpose of investment etc. Hence, for a beginner, an experienced mutual fund distributor / agent can support in decision making.

Entry load does not exist in MFs at present. However, agent/ distributor gets an income for the investments done through him. It shall be ensured by an investor that such agent/ distributor is capable of addressing the concerns. The investors should also try to understand the reasons for suggesting a specific scheme to him. An investor should never shy away from asking questions as the agent/ distributor is earning an income by doing his job and has the responsibility to assist the investor. Total Expense Ratio( TER) recovered will be inclusive of the amount payable to agent/ distributor. Financial institutions, including banks distribute MF schemes through their branches.

b. Applying MF schemes through the mutual fund website / office

An investor with reasonable awareness of functioning of mutual funds and sufficient expertise in choosing appropriate investment instrument can choose appropriate MF scheme by going to the online website of the fund house / office. While investing through website, investor has to mainly depend on his own expertise. While investing through the office of the fund house, investor can seek essential guidance from the office staff. Such investments are termed ‘Direct’ and compared to other investment methods, this mode is cheaper as MF house only recovers operational expenses and no commission. Total Expense Ratio in this case will be less compared to the investment through agent/ distributor as no commission outflow happens in this type of investment.

c. Applying MF schemes through online platforms of MF investment facilitators

Apart from the online investment facility offered by respective fund houses, there are many online websites that extends online facility for investment in mutual funds. Mode of functioning of such platforms is similar to agent/ distributor channel. These platforms earn commission on investments mobilized through them.

The major difference between investment made directly with fund house and this arrangement is on commission. Direct investment enables you to save commission. However, the service through these platforms is for a charge as in the case of agent/ distributor. Compared to the service of agents/ distributors, this investment can be carried out at your comfort and convenience. Such platforms also extend suitable advisory services. Further, investor need not visit different sites of various funds for making investments in different scheme. In this mode, the platform provides facility for investment to schemes floated by different MF houses by acting as an aggregator.

There are dedicated platforms supporting this mode of investment. Banks are also aggressive in this mode. They offer investment options through mobile banking and online banking platforms.

B.Allotment of Units

On acceptance the application and receipt of fund, the fund house allots the investor with eligible number of units. In an NFO, units are allotted at face value. If purchase is in an open ended scheme, units are allotted at prevailing NAV. In both cases, units can be received in demat account or held in physical form. If held in physical form, e-mail will be sent to the registered e-mail ID periodically for initial and subsequent purchases and also on monthly basis.

An investor can also open an online account with the MF house and can track his investment through online mode too.

In the case of ETF, units can be brought from stock exchanges at prevailing market rate and units are credited to demat account.

C. Disposal/redemption of Mutual fund investments

Investor can redeem mutual fund units at any time by surrendering to the mutual fund directly, if the investment is in an open fund scheme. The amount will be automatically credited to the account of the investor at the rate of prevailing NAV. Redemption request can be placed through online mode or through distributor/ agent/office.

Units of ETF will have to be sold through stock exchange.

Be First to Comment