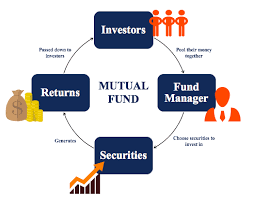

Mutual fund industry has become an important component of Indian economy. Mutual fund is a vehicle that mobilizes money from individual investors and channelizes household savings into the capital market. The fund invests in different markets, stocks and securities in line with the announced objective of the fund. Mutual fund has thus become an important instrument for private investment and wealth management.

Mutual funds and economy

Mutual funds accomplish different roles for different stakeholders. For investors, mutual funds act as an important instrument in earning regular income or building wealth by offering an easy way for participating in the opportunities available in capital markets. Mutual funds have the freedom to structure schemes to suit requirements of various categories of investors, within the overall broad guidelines specified by the regulator, Securities and Exchange Board of India (SEBI). Through these schemes, savings of households reach capital market which acts as a catalyst for economic growth of the country. Mutual funds tap large corpus of money from investors spread across the country.

The money that flows from savers to companies or other entities directly or indirectly is then invested in various projects generating employment opportunities. This boosts the economy of the country and contributes to the Gross Domestic Product (GDP) growth. GDP growth has direct bearing on the prosperity, development and life standards of the country. GDP growth enhances disposable income with citizens and income of government through increased tax collection. Government utilizes the tax payer’s money for various social welfare schemes for uplift of society and also for infrastructure projects to achieve higher level of growth.

Mutual fund, as a large investor in companies keeps track of the operations of the company, their performance, ethical standards and corporate governance. The watchful eyes of mutual funds ensure transparency in the operations of the companies, making them more accountable.

The mutual fund industry itself, generate employment opportunities as employees of mutual funds, distributors of mutual funds or schemes, registrars and various other service providers.

Mutual fund industry thus plays a pivotal role in employment generation, economic growth and nation building.

Mutual Fund Schemes

Mutual funds mobilize money from individuals with surplus savings over and above emergency funds. The preferences of individual investors vary in terms of risk bearing capability (low risk, medium risk, higher risk), amount of investible capital, preference on investment instrument ( stock, corporate bond, government securities etc),time horizon of investment (short term, medium term, long term etc), return expectation, investment goals or purposes (tax savings, corpus formation for education or marriage of children, retirement planning etc), income generation (monthly/ quarterly income, capital appreciation etc). Mutual funds design various products to suit preference of investors and create different pools of money. Each such pool is called a scheme. Each scheme mobilizes amount by specifying its investment objective. By subscribing to a mutual fund scheme, an investor buys into the investment objective. Often, mutual fund and mutual fund scheme are used to indicate same meaning.

Be First to Comment