Mutual Fund Investment has become the easiest way of entry to the stock market even for naïve investors, if concept of mutual fund investments is familiar. Returns from stock markets have always attracted investors world over to shares/equity and stock exchanges. However, many have burnt even the entire capital because of unfamiliarity with the behavior of shares. The importance of Mutual funds is that it provides an easy and riskless way of investing in shares and other financial instruments. Mutual fund has evolved as one of the smartest ways to invest your money! But a word of caution: Today there are so many mutual fund schemes and types and the chances of getting confused and picking the wrong ones are higher. Careless investment in mutual fund schemes to can lead to burning money.

Understanding the concept of mutual fund is very much needed to select the best performing mutual fund schemes. The one time effort to familiarize with the basic concepts of MFwill enable an investor to choose and pick the best instrument, especially since investing in mutual funds is evolving as the best investing options available in the market.

Basic concept of Mutual Fund Investment

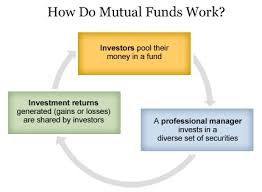

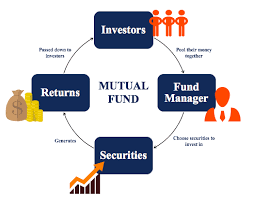

When you invest money in a MF scheme, you are entrusting the money to a company to take care of the fund. The company carries out this through fund managers having professional experience in investing. Management of each mutual fund scheme is carried out by a fund manager or a team of fund managers. The team has high level of knowledge, experience and professional expertise in investing. They leverage their skills and invest the money in the smartest and safest possible way so as to optimize return and risk. They invest the money in stocks, bonds and other investment options, depending on the type and objectives of the scheme.

The return from mutual fund investments comes in two ways:

a. Dividend

b. Appreciation in the value of NAV that represents capital appreciation. This can be realized by selling the units.

The amount of dividend, frequency of receipt and also capital appreciation in NAV depend solely on the performance of the mutual fund.

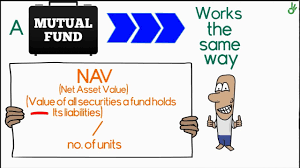

Concept of Mutual Fund Investment- Net Asset Value (NAV)

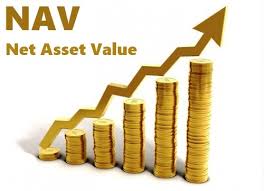

An investor in a mutual fund scheme receives units of the scheme in exchange. The price of each mutual fund unit is called its Net Asset Value (NAV). Understanding the concept of NAV is the first step towards investing in a MF scheme. NAV of a scheme indicates the performance of mutual funds.

Mutual funds collect huge amount of money from a large number of investors and invest in a diversified manner. A mutual fund scheme investing in the stock market will invest in shares belonging to multiple companies. This ensures that even if shares of some companies perform badly, better performance of other companies will average out the losses and the scheme value will remain stable. Due to this averaging effect, the NAV of a mutual fund scheme does not fluctuate as dramatically as an individual company’s share price. Therefore, any decrease/ increase in the NAV will be slow and steady. MF schmes have to announce NAV on daily basis and we can know the value of NAV of your investment as mentioned in the article – Know the Net Asset Value (NAV) of Your Mutual Fund Investment

Concept of Mutual Fund Investment- Charges and TER

The service provided by professional fund managers of mutual funds is not free. To compensate the service and to recover the costs, the MF levies fund management charges ( FMC ). The FMC levied varied across schemes from around 0.75% to 2.5% (the maximum charge permitted by SEBI of the total value of the mutual fund scheme. Now, SEBI has brought in the new concept of Total Expense Ratio (TER). Total Expense Ratio (TER) is the total charges a mutual fund house in India can charge to its investors.

The profit your funds earn from the investments will thus be reduced by the expenses. You may also be charged a non-time “transaction fee” (entry load) when you invest in a mutual fund scheme through a registered distributor. If you approach the mutual fund house directly, there is no such transaction fee. Entry loads are no longer applicable, however, there can be some kind of charges for some schemes. Sometimes, certain schemes stipulate minimum lock in period for redemption of units. If units are redeemed before the lock in period is over, the investor may have to pay an exit load, which also varies from scheme to scheme and type to type.

This explains the basic fundamentals of mutual funds. The complexity lies in the different types of mutual fund schemes available in the market. To enforce more clarity in formulation of schemes and also to make comparison of various schemes easier for investors, SEBI has stipulated norms for MF scheme categorization too.

Concept of Mutual Fund Investment- Investment to Redemption

The various broad steps involved from mobilization of fund to redemption are

i. Investor invests money in a Mutual Fund Scheme- This can be at the time of NFO or through purchase of units in an open ended scheme. Mutual Fund Houses offers easy options for investments

ii. Mutual Fund invests money in Stocks, Bonds, Government Securities, etc – Professional fund managers invest in underlying securities, debt instruments etc. in tune with the MF scheme objectives.

iii. Value of Mutual Fund increases / decreases due to investments made- The performance of a MF scheme is measured by observing NAV. Net asset Value of a scheme varies depending on the performance of underlying instruments.

iv. Investor receives dividend or sees increase in NAV per unit. Dividend is a share of profit released to investors who are holding units on the dividend deciding date. When dividend outflow happens, the NAV too decreases by the amount of outflow per unit. Increase in NAV represents capital appreciation and can be encashed only at the time of redemption.

v. Investor can sell mutual fund units at the current NAV. The investor can sell the unit at any time at prevailing NAV. However, in certain cases like ELSS, in certain closed end schemes etc, selling of units is permitted only after certain lock in period. Booking of capital appreciation/ capital depreciation happens at the time of selling units. Capital gain tax is applicable for such appreciation/ depreciation.

Be First to Comment