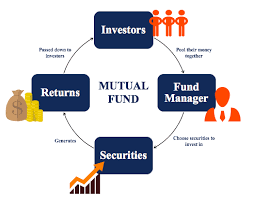

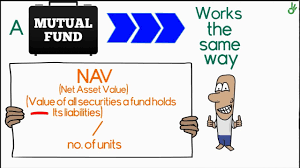

An investment in mutual Fund Scheme (MF scheme) entitles you to unit in lieu of the amount invested. The value of each mutual fund unit is called its Net Asset Value (NAV). Net Asset Value is the book value of each unit. Keeping track of the NAV enables an investor to understand the performance of mutual fund schemes.

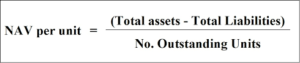

Calculation of Net asset Value (NAV)

The NAV of a mutual fund scheme is assessed by dividing the total value of assets the fund has by the total number of units outstanding. If the total value of the investments ( in shares, bonds, etc ) of a MF scheme is Rs. 100 crore and the number of outstanding units is 5 crore, the NAV of the scheme would be Rs. 20 ( 100 crore / 5 crore ). The increase in the value of investments made by the MF scheme leads to NAV appreciation too. In the above example, if the total value of the investments reaches Rs. 150 crore after some time, the NAV becomes Rs. 30 ( 150 crore / 5 crore ). The NAV goes down if the total value of the investments goes down.

It may be noted that the NAV is calculated after considering the payments to be made for investments already made, charges at the prescribed rate to be collected from investors etc. Accordingly, Net Asset Value (NAV) is calculated as shown below:

(The sum total of the market value of all the shares held in the portfolio including cash-less the liabilities) / Total number of units outstanding.

Mutual Fund schemes are required to declare NAV on daily basis and you can get details of the value from the websites of respective mutual fund houses or from that of Association of Mutual Funds in India-AMFI. MFInvestment.in readers can know the NAV of all mutual fund schemes by going to the article “Know the Net Asset Value (NAV) of Your Mutual Fund”.

Differences between NAV of Mutual Fund units and share value of equities

The NAV of a mutual fund unit is similar to the market value of a share traded in a stock exchange. However, there are three major differences between the two.

1. Shares are traded in whole numbers / integers. No investor can by a fraction of a share. But MF units can be brought/ sold in fractions. For example, for an investment of Rs. 10,000 at the NAV of Rs. 70, you will be allotted 142.86 units ( Rs. 10,000/ 70 ).

2. The NAV of mutual fund scheme does not undergo high fluctuation throughout the day like the value of a stock/equity. Other than a limited number of close ended mutual funds, other mutual funds are not traded on stock exchanges. Mutual funds invest in many stocks and instruments and the value change in one stock may be even out by the movement in other instruments. Further, majority of mutual fund schemes, calculate NAV just once in a day, normally at the end of each day. This is the price applicable for all buy / sell of MF units on that day.

3. The stock price may or may not decrease by dividend payment. However, when a mutual fund pays dividend, total value of the scheme too decreases thereby causing the NAV to reduce proportionally. For example, in the above mentioned example, if the mutual fund distributes Rs. 20 crore as dividend out of Rs. 150 crore, total asset value comes down to Rs. 130 crore ( 150-20). Thus each unit holder gets dividend of Rs. 4 ( 20 crore/5 crore) and the NAV goes down to Rs. 26 ( 130 crore/5 crore). Thus the value of dividend per unit and new NAV per unit equals the previous NAV (4+.26=30). Hence, payment of dividend does not make a mutual fund unit cheaper. Rather, it implies that the total asset value has reduced. Hence, the NAV of mutual fund scheme drops after payment of dividend. But, dividend payment does not have a direct relation to the market value of equity.

However, NAV helps to track the performance of the fund. Increase in the value of NAV indicates increase in the value of underlying securities and hence an indication of the expertise and efficiency of fund managers in choosing assets.

If you are going for best contents like myself, only pay a quick

visit this site daily because it gives quality contents, thanks

Hi! Someone in my Facebook group shared this website with us so I came to look it over.

I’m definitely loving the information. I’m book-marking and will be tweeting this to my followers!

Outstanding blog and brilliant design.

It’s hard to find well-informed people for this subject,

but you seem like you know what you’re talking about!

Thanks

Having read this I thought it was rather enlightening.

I appreciate you finding the time and energy to put this information together.

I once again find myself spending way too much time both reading and leaving

comments. But so what, it was still worthwhile!