Investing is all about taking calculated risk to earn steady rewards. Investing is the art and science of selecting and acquiring an asset that is suitable for the risk bearing capability of the investor and ensures steady rewards over a period of time. The main sources of income that we derive from an investment are capital appreciation, interests, dividends or rentals. Return is always in proportion to the risk one takes. Higher the risk, better the return. But, taking unreasonable risk for return is never part of investment; it is speculation. Whenever an investment is made, the investor has to live with the anxiety of unknown and that is an integral part of investments that offer better return.

Aim of investment

The basic purpose of investments is meeting life goals. Whatever be your goal, higher studies, marriage, acquiring a house or vehicle, preparing for a foreign trip or retirement, it can be converted into money terms. The aim of all investments is to ensure that your asset provides a return that is better than the inflation. Unless the asset you invest produces a return better than inflation, it gradually erodes the value of your investment. You will be able to generate surplus to take care of your future requirement, only if the return on investment beats inflation rate. Some of the various investment options available are shares, mutual funds, gold, bank deposit and government securities. Whatever be the investment instrument, the ultimate aim of investment is accumulating wealth at the best possible pace.

Saving Vs investment

Investment and saving are two words that are often substituted for each other. But the exact meaning of both words differs. Saving is keeping aside a portion of earning to be used for some purpose. Investment on other hand is keeping a portion of the saving in a specific investment instrument that gives a better return. The purpose of having savings is meeting unforeseen expenses. The purpose of investment is creating a corpus over a period of time. Thus, saving habit is a must for investment. Saving aims to keep the amount safe so that it can be used at any time. Investment aims to generate good return. Investing is all about taking calculated risks and managing the risk to get good return. In saving, avoiding risk gets priority. In investment too, taking unnecessary risks is a bad strategy. Saving is necessary to meet short term objectives, investing is essential to meet long term goals.

Right time to invest

A major portion of population is not having any investment. The root causes for this are lack of proper planning and proper execution. Even those plan properly, procrastinate investment waiting for opportune time. In fact, investment is for a longer horizon. The sooner you start investment, the better. Just like a tree take long time to grow and bear fruits, investment too needs time to generate a corpus..

Rules of investment

The thumb rules for all investments are

a. Start early

b. Invest regularly and

c. Invest for long time.

The time horizon of investment should be sufficiently long to get the benefit of compounding. The investor gets rewarded via compounding effect in two ways:

a. Income on original investment

b. Income on reinvested income.

The influence of compounding is the most fascinating aspect of starting early investment. The corpus formed over a period of time from consistent and regular investment is much higher than irregular and inconsistent investment.

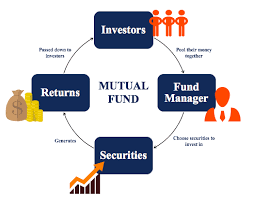

Investments in stocks after diligent analysis are considered the best investment option. The market volatility and resultant losses get nullified by the positive economic trend of the country. At the same time, consistent performance of the company multiplies the investment many times. This is the advantage of long term investment in the shares of a performing company. Mutual funds come to the rescue of those who find analysis and research of companies tough.

Investment instruments

The major investment instruments available presently in the market are:

Shares

Mutual Funds

Term deposits with banks

NSC and small savings with post offices

PPF

NPS

Bonds

Government securities

Minimum investment amount

There is no specific rule that exactly defines right quantum of investment to be made. The more the better. Any amount that you find convenient, after meeting your monthly expenses and that is set apart for meeting unexpected expenses, can be invested. The corpus that will be created depends on various factors like time horizon, risk profile of investor and amount of regular investment. In fact investments in mutual funds can be started even with Rs. 500.

Be First to Comment