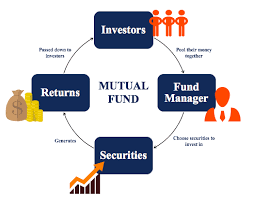

Every investor prefers to compare the performance of various mutual Fund Schemes before taking an investment decision. Mutual Fund Terminology related to such performance comparison is mentioned below.

Yield to Maturity or YTM

The Yield to Maturity or YTM is the rate of return expected on a bond if held till maturity. YTM is is expressed as an annual rate. YTM factors in the bond’s present market value, par value, coupon interest rate and time to maturity.

Modified Duration

Modified Duration is the percentage change in the price for a unit change in yield. It is a measure of the price sensitivity.

Standard Deviation

Standard deviation is a statistical measure of the range of an investment ‘s performance. The Mutual fund with a high standard deviation has greater volatility and a wide range of performance.

Beta

Beta is a measure of the volatility of investment vis-à-vis the market. Beta less than 1 means the security is less volatile compared to the market. Beta of 1 indicates that the security moves in alignment with the volatility of the market. A beta greater than 1 indicate that the price of the security is more volatile compared to the movement of the market.

Sharpe Ratio

William Sharpe is a Nobel Laureate who developed a formula to measure risk-adjusted returns. The Sharpe ratio is calculated using standard deviation and excess return to determine reward per unit of risk.

Mutual Fund Terminology: Most Common Terms

Mutual Fund Terminology : Nature or Objective of Investment

Be First to Comment