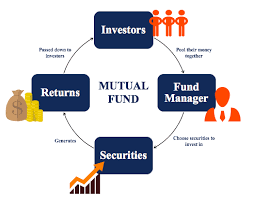

A Mutual Fund scheme application form, prospectus, or fact sheet repeatedly mention certain terms. A better understanding of Mutual Fund Terminology is essential for assessing different mutual fund schemes to make an investment decision. This article covers the most Commonly used Mutual Fund Terminology or terms.

Net Asset Value (NAV)

Net asset Value or NAV is the most common term used in relation to a mutual fund investment. NAV is the total asset value per unit of the mutual fund after deducting related and permissible expenses. The number of units an investor receives on investment (entry to the scheme) or the total amount paid to the investor on surrender of units (exit or partial exist from the scheme) depends on the NAV of the mutual fund scheme. The NAV is calculated at the end of every business day.

Application amount For Fresh Subscription

The minimum investment to be made by a new investor in a mutual fund scheme is called application amount for fresh subscription.

Minimum Additional Amount

This is the minimum amount required by an existing investor in a mutual fund scheme to acquire more units.

New Fund Offer (NFO)

New Fund Offer (NFO) is the term given to a newly launched mutual fund scheme in which an investor is permitted to make investments for the first time.

Entry Load

A mutual fund may collect a certain amount as sales charge or load at the time of purchase of units by an investor. The charge collected from the investor at the time of purchase of units is called entry load. Entry load is normally mentioned in percentage. For a mutual fund scheme having NAV of Rs. 100 and entry load of 1%, the amount to be spend by an investor to acquire one unit is Rs. 101. The entry load is used to compensate the distributor/ agent.

However, as per SEBI direction, entry load stands abolished since June 30, 2009. It is mandated that upfront commission to distributors, if any an investor pays, shall be paid by the investor directly to the distributor based on own assessment of various factors including service rendered.

Exit Load

The charge collected, if any, at the time of redemption of units by an investor is called exit load. This charge is also mentioned in percentage. If the NAV of a unit is Rs. 100 and the scheme has one percentage exit load, the n the net amount receivable by the investor per unit on redemption is Rs. 99.

Fund Manager

Fund Manager is an official or employee of the mutual fund asset management company responsible for the management of investments of the scheme.

Benchmark

Benchmark is a group of securities whose performance is used as a standard to measure investment performance of mutual funds. Benchmark is usually an index like the Nifty, Sensex, BSE 500, BSE 200 etc.

Systematic Investment Plan or SIP

Periodic investment of fixed sum on regular intervals is known as Systematic Investment Plan or SIP. It works like the recurring deposit schemes of banks. If an investor decides to invest Rs. 1000 per month on every 15th, for next three years, he opts for monthly Systematic Investment Plan or monthly SIP of Rs. 1000 each for next three years.

Asset Management Company (AMC)

The fund house or company that manages the fund is called an Asset Management Company or AMC.

Portfolio

Portfolio refers to all the investments made by the fund and the amount held in cash.

Corpus

Corpus is the total amount invested in a mutual fund.

Asset Under Management (AUM)

AUM or Asset Under Management refers to the cumulative market value of investments managed by a fund manager under a mutual fund scheme, on a recent date.

Holdings

Holdings refer to the shares of individual companies or other securities, in which the mutual fund scheme has invested on behalf of its investors. It is normally mentioned in terms of percentage to net assets or the rupee value or both. This gives an idea to the investors in which shares/securities the fund manager has invested.

Rating profile

Rating profile is mainly a feature of debt funds. Fund manager invests in securities after evaluating the rating, which is an indication of creditworthiness of the security. The depiction of the mutual fund in various investments based on their ratings becomes the rating profile of the mutual fund scheme.

Mutual Fund Terminology: Nature or Objective of Investment

Mutual Fund Terminology: Performance Comparison terms

Be First to Comment