Equity Linked Saving Scheme (ELSS) is a mutual fund scheme. It is popularly known as tax saving mutual fund investment.

What is Equity Linked Savings Scheme (ELSS)?

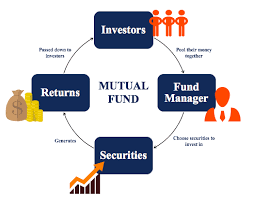

Mutual fund is an investment scheme that collects amount from numerous investors, pools the amount and invest in shares on behalf of the individual contributors. They charge a nominal fee for manging the fund. Mutual funds are regulated by SEBI.

ELSS is one type of mutual fund investment. ELSS is approved as one of the eligible investments to be considered under section 80 C. It is a tax saver investment. Investments in equity for a longer period, say above 5 years, have the potential to give inflation beating returns. To be eligible for consideration under section 80 C, the fund has to remain invested in ELSS for a minimum period of three years. This gives the freedom to the fund manager to stay invested in equity market without the fear of short term redemption.

Why is Equity Linked Saving Scheme ( ELSS) popular among tax payers?

- Provides opportunity to invest in equity market in a less risky manner. Fund managers are well experienced in equity markets and they ensure diversification.

- Section 80 C benefits for investments up to Rs. 1,50,000. There is no upper ceiling for investment, but Section 80 C benefit will be restricted to Rs. 1,50,000

- Potential to earn better returns compared to many other investment options under Section 80C

- Lock in period of 3 years is less compared to the lock in period stipulated for other investments under section 80 C. This it is one of the most liquid tax savers.

- Investment in ELSS enables the investors to realize short term and long term financial goals and act as part of financial planning. Investment can be done for longer period to meet requirement such as marriage expenses for children or own retirement requirements.

- Investment can be made in lumpsum or through SIP mode.

- Reduction from ELSS is tax free.

- Redemption from ELSS is tax free. Only securities transaction tax, STT, at 0.001% will be deducted.

- Mutual funds are regulated by SEBI. They are required to publish daily NAVs (Net Asset Value) of each fund. Hence the operation of ELSS is transparent and investor can track the performance of investment.

Be First to Comment