Mutual fund is emerging as one of the best ways of investing. It acts as a vehicle of wealth creation

What exactly is a Mutual Fund?

There are many of investors who wish to invest in shares or bonds. Majority of them lack required expertise and time for research that are essential for direct investments in shares and bonds. They keep a major portion of their money in savings bank accounts or fixed deposits with banks. The interest rates on these investments are often less than the inflation rate.

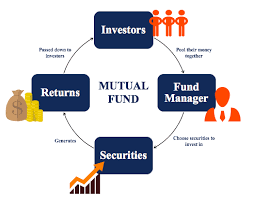

Mutual fund is a financial asset and a best investment option. Mutual fund collects amount from numerous investors, pools the amount and invest in shares on behalf of the individual contributors at a nominal fee. The investors are allotted units in proportion to their investment. The gains and losses are shared among the individual investors on equal basis in proportion to individual investment.

What are the advantages of Mutual Fund investments?

For an investor, the Mutual Fund investment offers a plethora of benefits and major among them are:

a. Funds are managed by qualified professionals having sufficient experience.

b. As the investment is made on behalf of a large number of investors, it is cost effective.

c. Mutual Funds are well regulated by SEBI

d. Mutual Funds permit you to decide the quantum of investment. Investments can be in lumpsum or of recurring nature starting even from Rs. 500/- p.m.

e. Investors have the freedom to choose the fund that suits their risk profile. Mutual Fund investments in bonds and Government securities carry less risk. Investments in shares carry higher risk but better returns.

f. Freedom to select suitable period. Mutual Fund investments in bonds and government securities are best suited for short term investments whereas Mutual Fund investments in shares are more suitable for medium term to long term investors.

Please go through the tutorial (Courtesy: IDFCmf.com) for better clarity.

Disclaimers

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Certain factual and statistical information (historical as well as projected) pertaining to Industry and markets have been obtained from independent third-party sources, which are deemed to be reliable. It may be noted that since mfinvestment.in has not independently verified the accuracy or authenticity of such information or data, or for that matter the reasonableness of the assumptions upon which such data and information has been processed or arrived at; mfinvestment.in does not in any manner assures the accuracy or authenticity of such data and information. Some of the statements and assertions contained in these materials may reflect mfinvestment.in’s views or opinions, which in turn may have been formed on the basis of such data or information.

Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision. None of the employees of mfinvestment.in, authors, promoters, affiliates or representatives shall be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this article or reference articles/videos/sources.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Be First to Comment