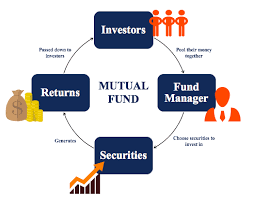

Net Asset Value (NAV) is the most frequently used term in association with mutual funds. Mutual fund is a financial asset and a best investment option. Mutual fund collects amount from numerous investors, pools the amount and invest in shares on behalf of the individual contributors at a nominal fee. The investors are allotted units in proportion to their investment. The gains and losses are shared among the individual investors on equal basis in proportion to individual investment. The value of this unit at any particular time is mentioned as the Net Asset Value (NAV) of the scheme.

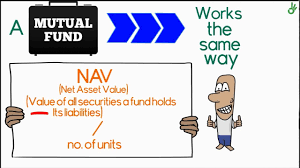

Net Asset Value (NAV) is calculated as shown below:

(The sum total of the market value of all the shares held in the portfolio including cash-less the liabilities) / Total number of units outstanding.

Thus, NAV of a mutual fund unit represents nothing but the 'book value'. Changes in the value of NAV gives the clear picture of the performance of fund.

All mutual funds are required to publish the NAV of each scheme at every business day as per SEBU Guidelines.

To know the Net Asset Value (NAV) of your fund please read the article Know the Net Asset Value (NAV) of Your Mutual Fund.

The article Net Asset Value (NAV) of a MF Scheme and Its Calculation describes the differences between the market value of equity and NAV of mutual fund scheme.

Disclaimers

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Certain factual and statistical information (historical as well as projected) pertaining to Industry and markets have been obtained from independent third-party sources, which are deemed to be reliable. It may be noted that since mfinvestment.in has not independently verified the accuracy or authenticity of such information or data, or for that matter the reasonableness of the assumptions upon which such data and information has been processed or arrived at; mfinvestment.in does not in any manner assures the accuracy or authenticity of such data and information. Some of the statements and assertions contained in these materials may reflect mfinvestment.in’s views or opinions, which in turn may have been formed on the basis of such data or information.

Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision. None of the employees of mfinvestment.in, authors, promoters, affiliates or representatives shall be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this article or reference articles/videos/sources.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Hello, after reading this awesome post i am as well delighted to share

my experience here with colleagues.