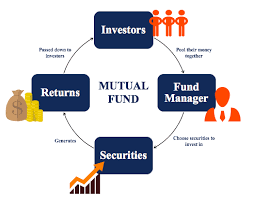

Total Expense Ratio (TER) is the total charges a mutual fund house in India can charge to its investors. It is a consolidation of various charges like management fees, marketing costs, transaction costs and distributor commissions. As per SEBI directive, mutual funds are obliged to inform changes in Total Expense Ratio (TER) to its investors apart from publishing scheme wise TER daily in the website. The details in the website shall be updated as and when TER changes to ensure transparency.

Is there any cap on the Total Expense Ratio (TER)?

As per the SEBI instruction, the TER can vary from scheme to scheme based on the efforts to be put in the fund house to manage the fund. The maximum TER that can be charged varies from 1.5 to 2.5 per cent based on the scheme. The charge is to be calculated on the average asset under the scheme. To encourage investments from smaller cities and towns, fund houses have been given freedom to charge additional 0.3 % (maximum) plus GST on the inflows from such centres. This along with the base TER will be the total TER applicable for the scheme for inflows from such centres.

Will Total Expense Ratio (TER) have a huge impact on the return?

The impact of the TER on the maturity corpus depends on the nature of fund and also the period of investment. Equity or hybrid schemes provide annual return between 10-15 per cent. Hence even a 0.5 per cent increase in the TER for this scheme may not have much impact unless the investment is for a long period. The annual return from debt funds is normally in the range of 6-7 per cent. Hence, even a lesser increase of 0.2 percent can have huge impact on the return from such schemes.

For example, an equity fund with 1.5 per cent TER and 15 per cent annual return, converts your ₹ 50,000 investment into Rs. 3.34 lakh at the end of 15 years. With a TER of 2 per cent, your final quantum will be Rs. 3.13 lakh.

Should an investor discontinue investment if TER is increased?

Decision on discontinuation has to be made based on various parameters. If your investment is consistently giving better return compared to relative index or the return for similar schemes by competitors, then additional charge is justifiable. This is because the NAV is fixed after deducting TER. You also must compare the TER for similar schemes by different fund houses before taking the final decision.

After the directives of SEBI on rationalization of schemes, comparison has become much easier. TER is another attempt on the part of SEBI in ensuring transparency.

Should an investor switch to direct plan or continue with distributor mode for investment?

When direct plan is opted, an investor should have basic understanding of market factors and sufficient time to read, compare different schemes and take suitable investment decision. If the investor needs advice on selecting suitable scheme and to complete formalities, distributor or agency mode is better. The charge you have to pay as distributor or agency commission can be arrived at by comparing TER for direct plan and regular plan. If TER for direct investment is 2.25 per cent and that for regular mode is 2.75 per cent, the commission payable to the agent is 0.50 per cent. If the advice and support from the distributor enables an investor to improve returns, then agency mode is better for the investor.

Be First to Comment