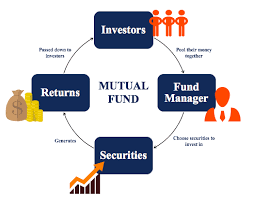

Mutual fund schemes mobilize money from individual investors and channelize household savings into the capital market and debt market. Professional managers of the mutual fund investment schemes provide investors the opportunity to earn an income or build their wealth with minimum headache. This is the major advantage associated with investments through mutual fund schemes. There are many other advantages and disadvantages associated with mutual fund investment and they are enumerated below:

Advantages associated with mutual fund investments

Portfolio diversification enables investors to create a better portfolio. Even Rs.10,000 invested in a mutual fund scheme is diversified across equities and debts of different characteristics based on the investment objectives of the scheme. Thus each unit of a mutual fund scheme ensures exposure to a range of securities. Diversification ensures the basic principle of investment. ie all the egg is not in the same basket. This reduces the scope for loss of corpus as all the investments cannot go bad at the same time. To build an investment portfolio resembling mutual fund scheme, investors will have put in lot of time, energy and money. But, in mutual fund investment, diversification is ensured even for minimum investment.

The pooling of large sums of money from so many investors enables the mutual funds to distribute the operational cost across a group. Thus, the charges of professional managers get distributed among a group of investors and make the charge affordable for individual investors. Even small investors get the benefit of professional management at affordable costs. At the same time, the fund managers get more freedom to distribute the costs related to research and other operational costs. This gives them better opportunity to explore the best practices without concern of costs. Considering the volume of funds associated with each scheme, fund managers can negotiate better terms with brokers, bankers and other service providers and reduce the overall cost.

Mutual fund investment reduces the risk of illiquid investments. Individual investors in equity through stock exchanges have often witnessed many stocks turning illiquid investment as even some of the companies vanish from the field. Mutual fund investment protects the investors from this risk as professional managers are engaged in the management of fund, doing researches and monitoring on full time and continuous basis.

Liquidity is another feature offered by mutual fund schemes. Investors can easily liquidate full or part of their investment by simply giving redemption request to the branch of the mutual fund or their associates. All mutual fund schemes now offer facility of redemption through online too. However, redemption facility depends on the scheme features. They specify whether redemption is possible at any time, or during specific intervals, or only on closure of the scheme. Schemes where the money can be recovered from the mutual fund only on closure of the scheme are listed in a stock exchange (Exchange Traded Funds). In such schemes, amount can be recovered by selling the units in the stock exchange at the prevailing value of the investment. Investors can structure their investments in line with their liquidity preference and tax position

There are mutual fund schemes that offer tax benefit for the investments in certain specified schemes like Equity Linked Saving Scheme (ELSS). This is offered under Section 80 C of income tax rules. This reduces the taxable income of investors and therefore the tax liability. Capital appreciation gets tax advantages compared to many other investments. Dividend income also gets better tax treatment. However, the tax benefits may vary from year to year depending on tax rules.

The convenience associated with further investment in mutual funds is another advantage. Once a relation is created with a mutual fund, further investment can be made with minimum documentation, thus simplifying the investment activity.

The regulator, Securities & Exchange Board of India (SEBI) ensures strict checks and balances in the structure of mutual funds and their activities. This ensures safety and liquidity of mutual fund investments.

Multiple options available for investment and withdrawal enhance convenience of mutual fund investment. They are

i. Regular investment through Systematic Investment Plan (SIP)

ii. Regular withdrawals through Systematic Withdrawal Plan (SWP) and

iii. Shifting of investment between different schemes through Systematic Transfer Plan (STP).

Such systematic approaches promote investment discipline, which is useful in long term wealth creation and protection be leveraging compounding effect.

Disadvantages associated with mutual fund investments

Under Portfolio Management Schemes (PMS) available to large investors, some securities houses offer better control over the kind of securities to be bought and sold on his behalf. However, in mutual Fund investment, a unit-holder is just one among many and such control is not available for the investor. The investment choice is left with the fund manager, within the broad parameters of the investment objective of the scheme. However, many retail and small investors prefer mutual fund routes for lack the time or the knowledge to make portfolio choices and hence this disadvantage is not a serious limitation in most cases.

There are multiple mutual fund schemes offered by multiple mutual fund houses. The multiple options and multiple schemes often make it difficult for investors to choose between them. Greater information dissemination through various media and availability of professional advisors in the market, helps the investors to overcome the limitation. Further, ‘Categorization and Rationalisation of MF Schemes- SEBI Directive’ also ensures transparency in mutual fund investments. .

Be First to Comment