In India, the concept of planning for retirement is yet to get required attention. The practice in India is to give least priority to retirement planning. The family system in India has been strong and parents have been confident that their children would take care of them during their retired period. There have been lot of cultural, social, economic and value system changes in the recent past. Nuclear family is gradually replacing the old family concept. These changes have made planning for retirement essential. Many have started realizing that they must plan for retirement too.

While people visualize retirement as a phase in life without many responsibilities and time to do the most cherished and kept aside dreams, the fact is that retirement is a ticking time bomb, which was turned on at the time of one’s birth itself. In fact, it is a period of time where your expenses for medical care is shooting up and income and income generating capacity are going down. Hence, you need to have a corpus at the time of retirement to take care of future expenses. The corpus formulation should be started at the moment you start earning. If not, at least now.

Why retirement planning is essential?

Retirement planning in India is necessary because of the following reasons:

• Lack of sufficient social security and pension provisions

• Presence of inflation which makes the cost of living go up

• Lower income generating capacity due to health factors

• Unforeseen medical expenses and zooming expenses

• Increased life expectancy

How much corpus is required for retirement phase?

It is a tough question to answer because the quantum of corpus required depends on lot of factors like

• Your lifestyle

• Your health

• Your life expectancy

• Future inflation

• Future tax rules

• Quantum already been built up/ pension

• How much income you can earn on your corpus in future

• Unexpected expenses like sudden medical requirement

It is never possible to arrive at a perfect number. So the best thing is to have some assumptions and try to build up a corpus from now on.

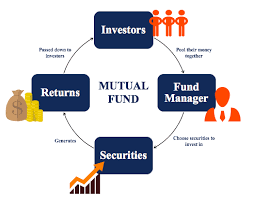

Here is small calculator (Click Here button) that you will find useful to have a fair assessment based on your assumptions. In the page, go to the bottom and click on the tab Retirement (Courtesy: BNP Paribas Mutual Fund.)

Disclaimers

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Certain factual and statistical information (historical as well as projected) pertaining to Industry and markets have been obtained from independent third-party sources, which are deemed to be reliable. It may be noted that since mfinvestment.in has not independently verified the accuracy or authenticity of such information or data, or for that matter the reasonableness of the assumptions upon which such data and information has been processed or arrived at; mfinvestment.in does not in any manner assures the accuracy or authenticity of such data and information. Some of the statements and assertions contained in these materials may reflect mfinvestment.in’s views or opinions, which in turn may have been formed on the basis of such data or information.

Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision. None of the employees of mfinvestment.in, authors, promoters, affiliates or representatives shall be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this article or reference articles/videos/sources.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Be First to Comment